There are 2 parts to the whole process of TDS on Sale of Property.

Part-1 is to pay TDS to govt account through online filing of Form 26QB (TDS Return)

Part-2 is to issue TDS certificate ‘Form 16B‘ to the Seller.

Part-1 Filing Form 26QB (TDS Return)

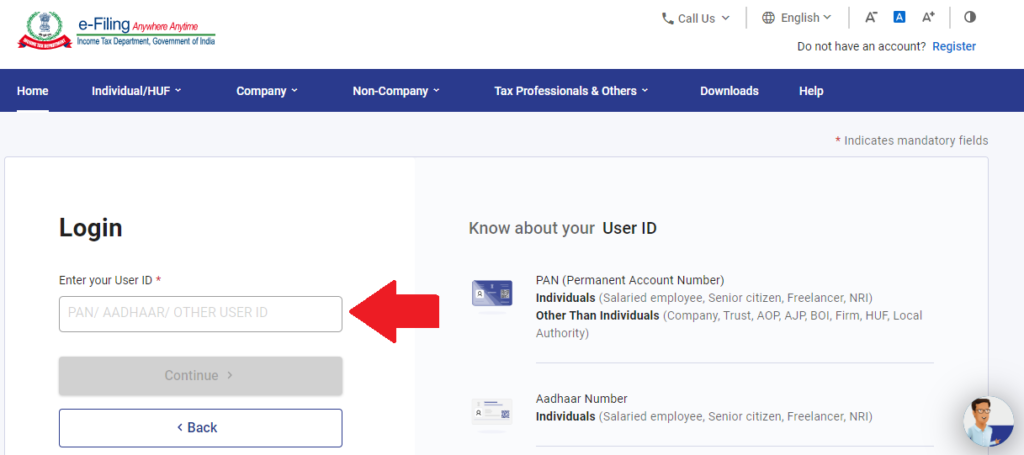

Step-1: Log in to your account on the income tax portal www.incometax.gov.in using your PAN.

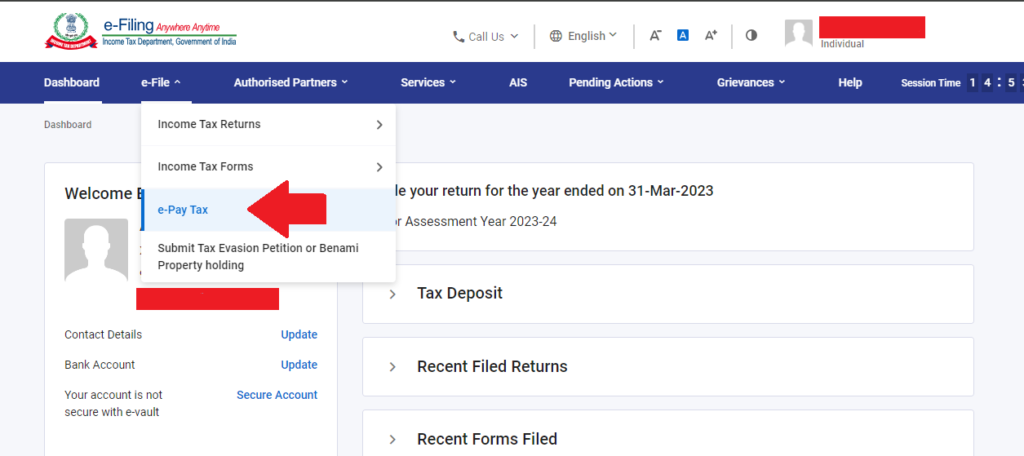

Step-2: Select e-File and then, click on e-Pay Tax from the drop-down as shown in the image below:

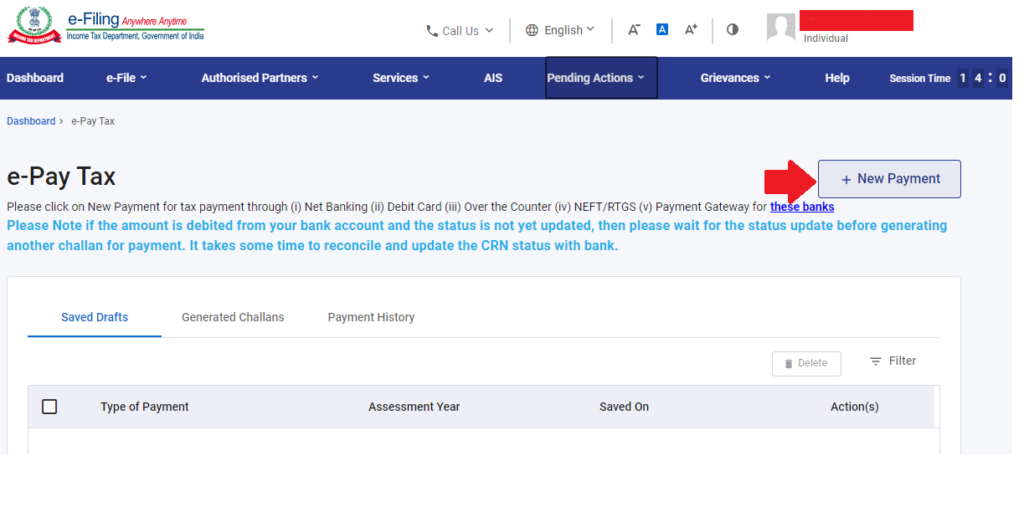

Step 3: Now, click on + New Payment (as shown in the image below)

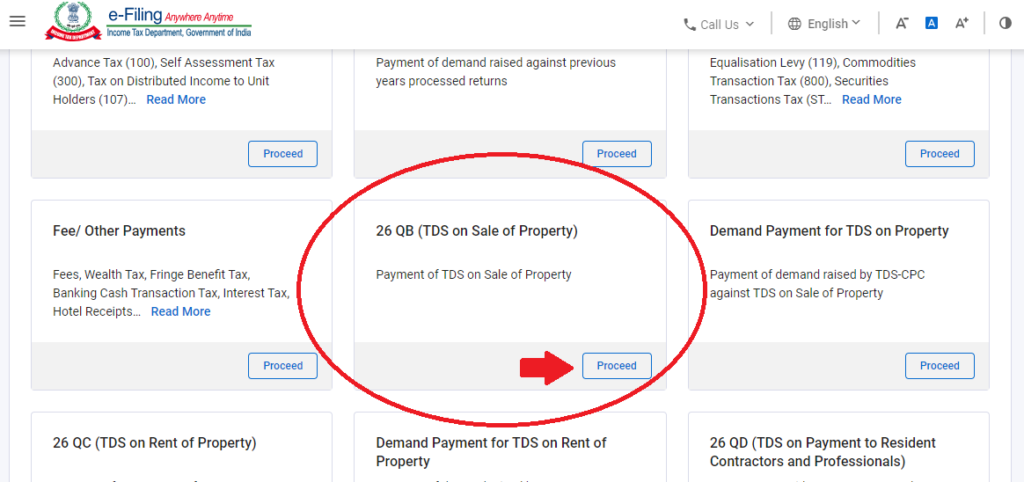

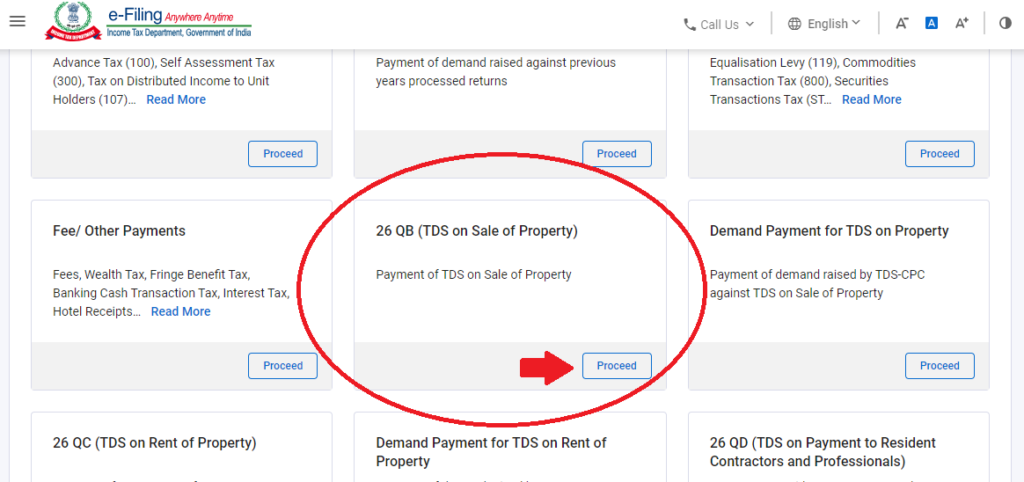

Step 4: Now click on ‘Proceed‘ as shown in the image below:

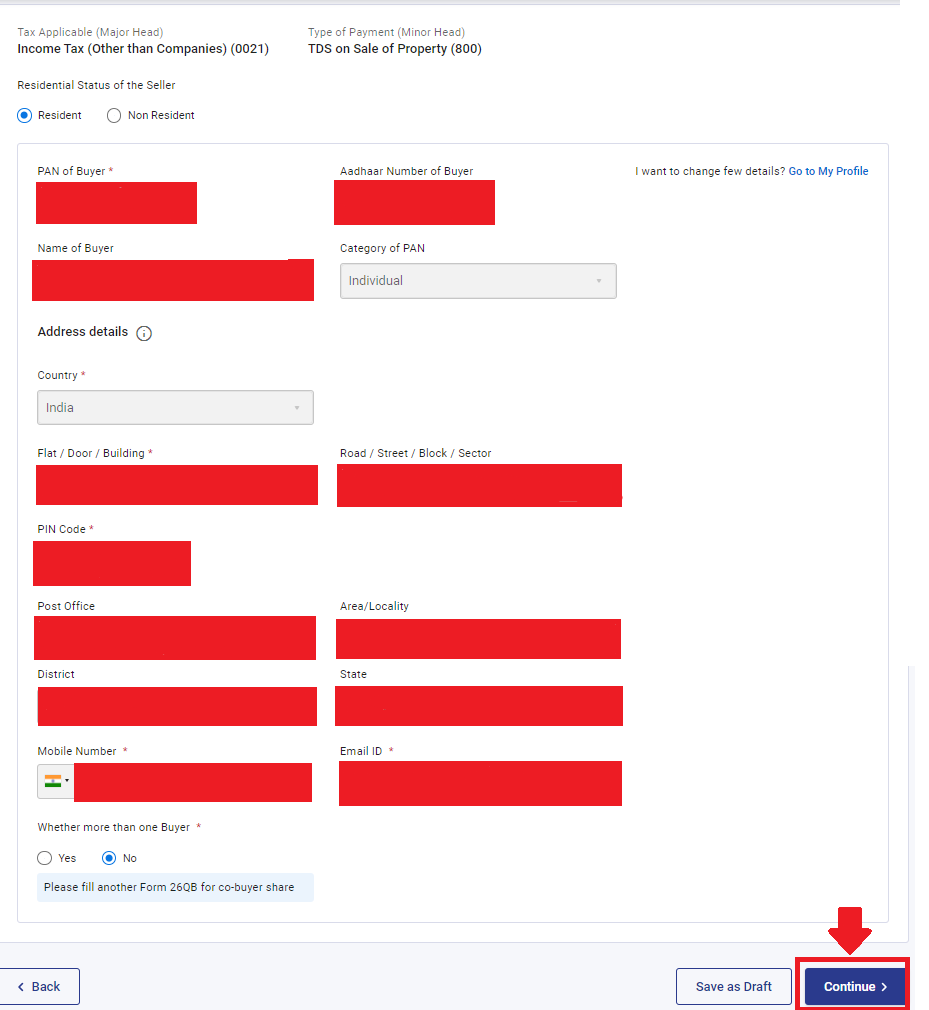

Step 5: Now, in the next page, you will be required to fill the details of the Buyer. Most details will be auto-filled as this form is to be filled from the Buyer’s e-filing account.

Point to be noted: The top left corner of the page above requires you to select the Residential Status of the Seller. In case you select “Non-Resident”, you will be prompted to file Form 27Q i.e. regular quarterly TDS return under section 195 using TAN credentials of buyer. See image below:

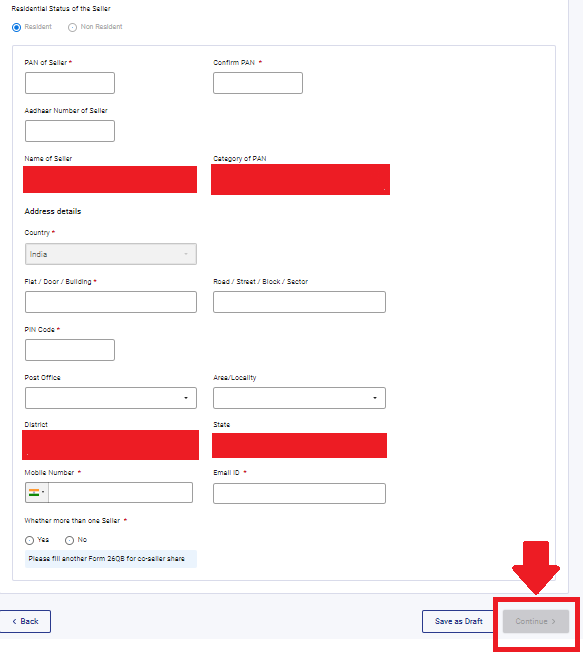

Step 6: Add Seller’s details like PAN, Address with pincode, Phone, Email etc

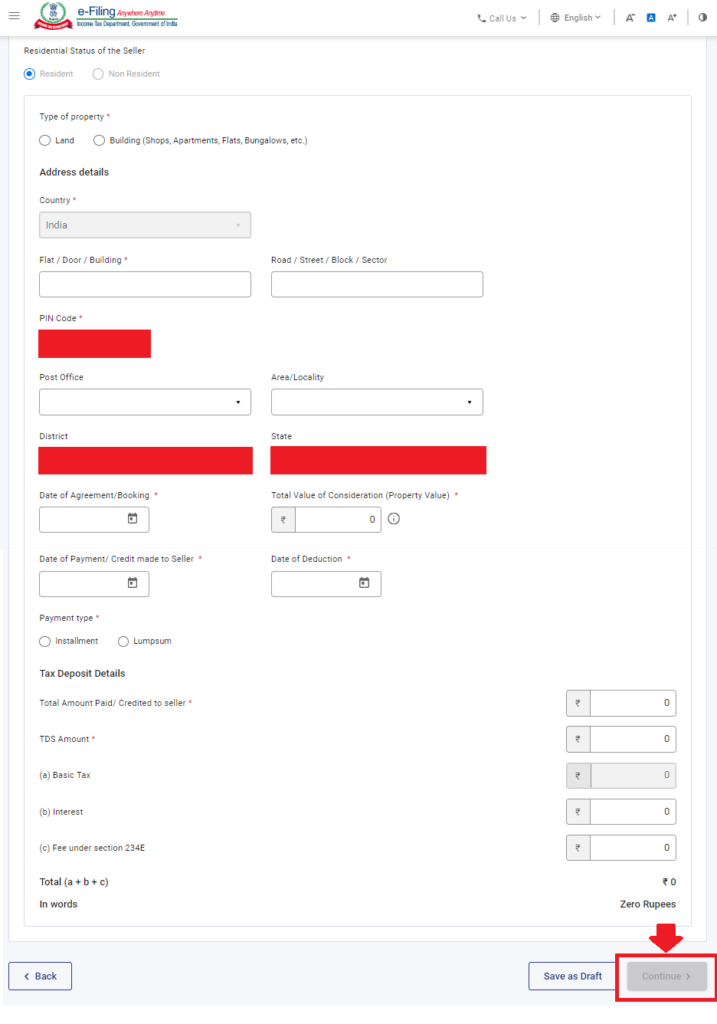

Step 7: Add Property Details

| 1. Type of property (Land or Building) 2. Full address with pincode 3. Date of Agreement 4. Total Sale consideration (Property Value) 5. Date of payment made to seller 6. Date of deduction (in most cases the date of payment and date of deduction will be same) 7. Payment type (Installment or lumpsum) |

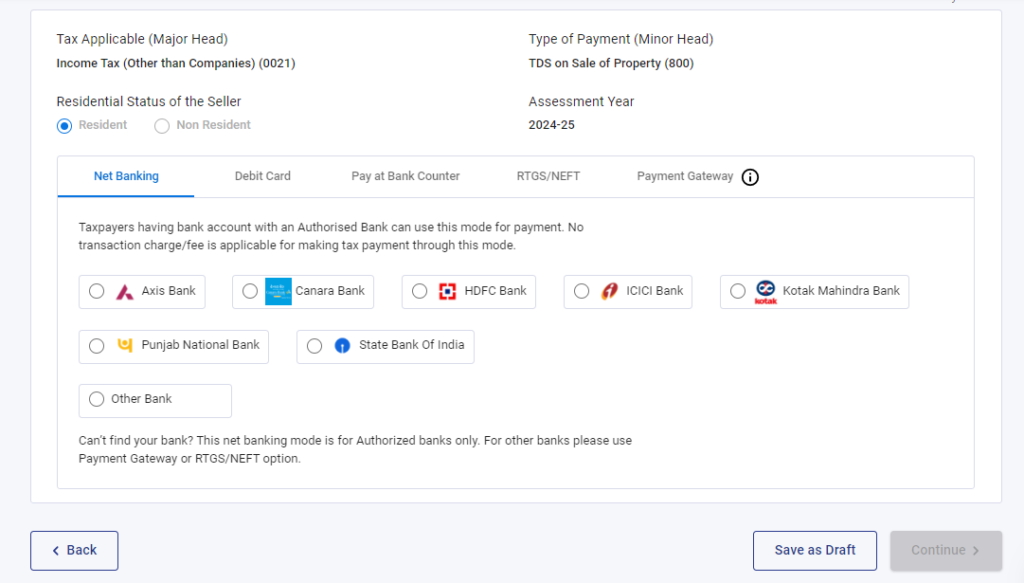

Step 8: Next step is to make the relevant TDS payment. You can choose from various ways offered by the e-portal as shown in image below:

ONCE THE PAYMENT IS DONE, A CHALLAN WILL BE GENERATED, WHICH SHOULD BE DOWNLOADED INSTANTLY

Part-2 Issue of TDS Certificate ‘Form 16B’ to the Seller

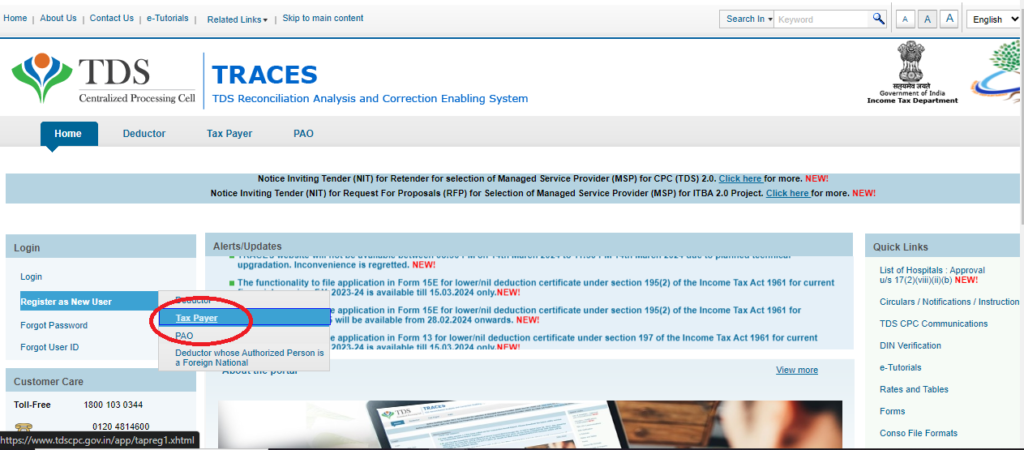

Just as www.incometax.gov.in is e-filing portal for income tax & TDS filings, similarly contents.tdscpc.gov.in commonly known as TRACES, is a centralized processing cell for issuance of TDS Certificates.

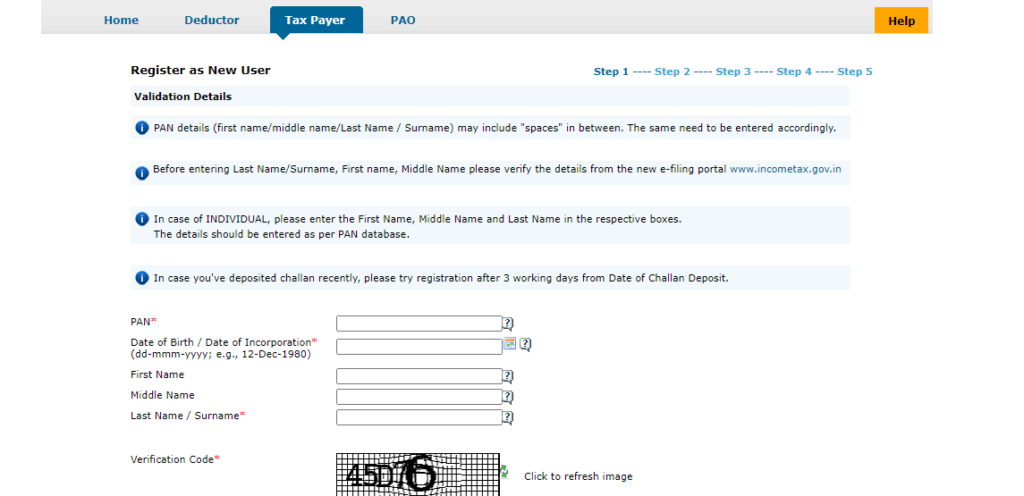

Step 1: Go to TRACES. If you are a first time user, register your PAN, Date of Birth and Full Name

Register as NEW USER and as a TAX PAYER (as shown in image below)

Give details of PAN, Date of Birth and Full Name

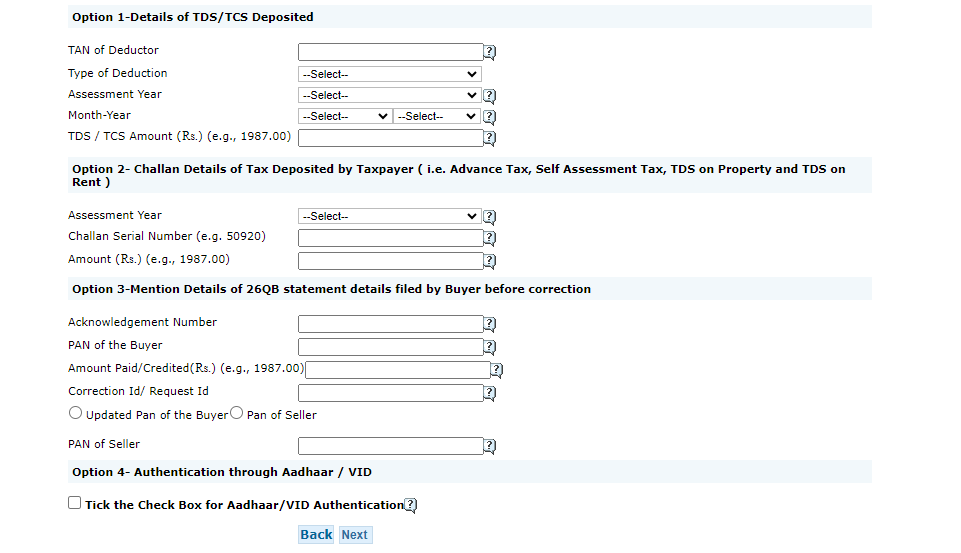

Then, in next page, validate your registration by using options 2 or 3 (as shown in image below):

Once you register, you can then login to your account on TRACES using PAN credentials and request download of Form 16B TDS Certificate to be issued to the Seller.

Step 2: Download of TDS Certificate Form 16B

The TDS amount that you have deducted and paid through Form 26QB, should reflect in your Tax Credit Statement 26AS within 6-7 days, under “Details of Tax Deducted at Source on Sale of Immovable Property u/s 194(IA)“

Once you see it reflecting in your 26AS, login to your TRACES account using PAN credentials.

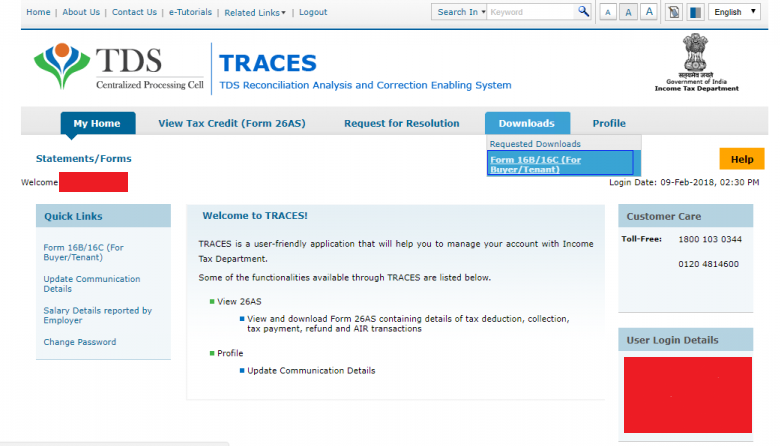

Go to DOWNLOADS and click on Form-16B (For Buyer/Tenent) as shown in image below:

| 2.1 Once you click on Form-16B (For Buyer/Tenent) as shown above, you will be prompted to fill details such as: PAN of Seller Acknowledgement number (as mentioned in TDS challan) Assessment year and then click on ‘PROCEED‘ |

| 2.2. Confirm details to be printed on Form 16B and click on Submit Request |

| 2.3 After a few hours, your request for TDS Certificate Form 16B will be processed. Go to DOWNLOADS and click on REQUESTED DOWNLOADS from the drop-down menu |

| 2.4 The request status should show as ‘available‘. If the status shows ‘submitted‘, wait for some more time for it to change to ‘available‘ |

| 2.5 Once ‘available‘, download the .zip file and extract the TDS Certificate Form 16B as pdf file. The password to open file is Date of birth of Buyer (Deductor). |

| 2.6 Issue this certificate to the Seller |

Filing of Form 26QB and issue of TDS Certificate Form 16B is – Mandatory

As per the Finance Act of 2013, TDS is applicable on the transfer of immovable property, wherein the consideration of the property exceeds or is equal to Rs 50 Lakhs.

The income tax department receives an Annual Information Return (AIR) from the registrar/sub-registrar office regarding the purchase and sale of property regularly. From this report, the department can figure out if you have made a property transaction exceeding Rs.50 lakh.

If the buyer has not deducted tax at source at 1% of the transaction amount or not filed TDS within the specified time, the IT department will send a notice to the buyer for non-filing of Form 26QB (TDS Return).

Penalties for Non-filing of Form 26QB (TDS Return)

| In case of | Penalty |

| Not deducting TDS | 1% per month from the date on which you were supposed to deduct TDS until the day on which you actually deduct TDS. |

| Not depositing TDS using online Form 26QB | 1.5% per month from the date on which TDS is deducted to the date of payment to government. |

Additional penalties

| 1. Late filing fee under section 234E @ Rs. 200 Per day: If you do not submit or delay in submitting Form 26QB, you may have to pay a fine under section 234E. The fine is Rs. 200 per day until you submit Form 26QB. The buyer would be liable for defaults of late deduction, late payment and interest. |

| 2. Penalty under section 271H: Assessing Officer may levy penalty under section 271H at his discretion. This section is applicable when a statement as required by the tax laws is not submitted timely. Minimum penalty under this section is Rs 10,000 and it may go up to Rs 1 lakh. But if they pay TDS with late fee & interest and submit the statement within 1 year of the time allowed, they won’t have to pay any penalty. |

FAQ’s Frequently Asked Questions

I am a buyer of the property, am I required to obtain TAN to deduct TDS on sale of property?

Buyer or Purchaser of the property is not required to procure Tax Deduction Account Number (TAN). All that is required is the buyer’s and sellers PAN to file Form 26QB (TDS Return)

Can I file Form 26QB (Section 194-IA) if the Seller is a Non-Resident (NRI)?

No. In such a case, regular quarterly TDS Return has to be filed. The buyer(s) will have to obtain TAN (if not already obtained) and file quarterly TDS return under section 195.

If there are multiple buyers and sellers, how do we file Form 26QB?

The Form 26QB challan has to be filled by each buyer for every unique buyer-seller combination for their respective share.

For example, in the case of one buyer and two sellers, two forms have to be filled in. Similarly, if there are two buyers and two sellers, then four forms will have to be filled in.

Do I have to file Form 26QB if the payment and registration of the property was done before May 2013?

Form 26QB is applicable on the purchase of properties after 1 June 2013. Hence, for properties where the formalities were completed before this date, there is no requirement to file Form 26QB.