TDS on Sale of property – An overview

When you buy or sell an immovable property (Land or building or part of a building) in India, the buyer (Transferee) is supposed to deduct tax on the amount paid/to be paid to the seller. Just like tax (TDS Tax Deducted at Source) is deducted on salary or professional income, similarly, a buyer is supposed to deduct TDS (Tax Deducted at Source) under a new section 194-IA, at a rate of 1%.

‘Immovable property‘ means any land (other than agricultural land) or building or a prt of building.

‘Transferor‘ is a legal term for Seller, ‘Transferee‘ is a legal term for Buyer.

What is Section 194-IA?

When a buyer buys an immovable property (land or building or a part of building) in India, other than an agricultural land, costing (Sale Consideration) more than 50 lakh Indian rupees, he is supposed to deduct TDS (Tax Deducted at Source) at the rate of 1%, when he pays the resident seller.

This section 194-IA is applicable since 1st June 2013.

Points to be noted:

| 1. The Buyer has to deduct TDS (Tax) at a rate of 1% on the total amount paid/ to be paid to the Seller. |

| 2. TDS is required to be deducted only if the total ‘Sale Consideration’ exceeds 50 Lakh Indian Rupees. |

| 3. If payment to the Seller are to be made in installments, TDS should be deducted for each installment. |

| 4. ‘Sale Consideration’ i.e. the cost of property shall include all charges of the nature of club membership fees, car parking fees, maintenance fees, advance fees, electricity or water fees, or any other fees which are incidental to the transfer of the immovable property. This is applicable to immovable property purchased on or after 1st September 2019 as per Budget 2019. |

| 5. The Buyer does not need to obtain a TAN (Tax Deduction Account Number) for depositing TDS with the Government. PAN of Buyer(s) and Seller(s) is sufficient. |

| 6. For depositing TDS, Buyer(s) needs to obtain PAN of Seller(s). If the Seller(s) fail to furnish PAN, then the Buyer(s) is liable to deduct tax at the rate of 20%. |

| 7. The TDS (tax) has to be paid using Form 26QB within 30 days from the end of the month in which the TDS (tax) was deducted. |

| 8. The Seller(s) can be more than one person, and must be Resident of India. |

| 9. The Buyer(s) can be more than one person, and can either be Resident of India or Non-Resident (NRI). |

Illustration: When both Buyer and Seller are Residents

Mr. A (Buyer), a resident of Lucknow (UP) decides to buy a house (located in Agra) from Mrs B (Seller), a resident of Delhi, for a Sale Consideration of 67 Lakh India Rupees i.e. Rs. 67,00,000 only. Mr. A (Buyer) has to deduct 1% on the full Sale Consideration amount Rs. 67,00,000 i.e. Rs. 67,000 and pay the remaining amount of Rs. 66,33,000 only to Mrs. B (Seller). The TDS amount of Rs. 67,000 is to be deposited in govt account using PAN details of Mrs. B (Seller).

Illustration: When Buyer is NRI (Non-Resident) and the Seller is Resident

Mrs. A (Seller) sells her house in Mumbai to an NRI Mr. B (Buyer), a resident of London (UK), for a Sale Consideration amount of 93 Lakh Indian rupees i.e. Rs. 93,00,000 only. Here, as the Seller is an Indian Resident, provisions of Section 194-IA will be applicable. Hence, Mr. B (Buyer) is liable to deduct TDS at the rate of 1% of Rs. 93,00,000 i.e. deduct Rs. 93,000 and pay the remaining amount of Rs. 92,07,000 to the Seller Mrs. A. The TDS deducted (Rs. 93,000) should be deposited in govt account using PAN details of the Seller.

Illustration: When Buyer is a Resident and Seller is an NRI (Non-Resident)

In case where a Non-Resident (NRI) person, who wants to sell his/her immovable property situated in India, to a Resident Indian, the provisions of Section 194-IA do not apply. In such a case, provisions of Section 195 will apply. For further details, click here.

Illustration: When there are more than 1 Seller

Mr & Mrs. X (Sellers) are joint owners of a house in Kolkata (West Bengal). They decide to sell their house to Mrs. Y (Buyer), a resident of Kerala. The Sale Consideration amount is Rs. 56,00,000. Both the sellers have equal share i.e. Rs. 28,00,000. It may seem that individually the sellers are getting less than the TDS deduction limit of Rs. 50 Lakhs. But in this case also, as the aggregate Sale Consideration is more than Rs. 50 Lakhs, the Buyer is liable to deduct TDS at 1% of the each sellers share i.e. 1% of Rs. 28,00,000 each, and deposit the TDS in govt account using the individual PAN’s of Sellers.

Sale Consideration Vs Stamp Duty Value

In considering the amount on which the TDS is to be deducted, the Buyer has to take the higher of Sale Consideration and Stamp Duty value.

‘Sale Consideration‘ is the amount mutually decided by Buyer(s) and Seller(s) for the transfer of immovable property.

‘Stamp Duty Value‘ is any value adopted by the relevant state/central authority for the purpose of payment of stamp duty.

An Example: You sold your house to Mr. X for a Sale Consideration of Rs. 60,00,000. However, as per the circle rates and stamp duty value, the amount on which the stamp duty is to be paid, is Rs. 70,00,000 and the same is mentioned in the registry. Hence, Mr. X is liable to deduct TDS at the rate of 1% on Rs. 70,00,000.

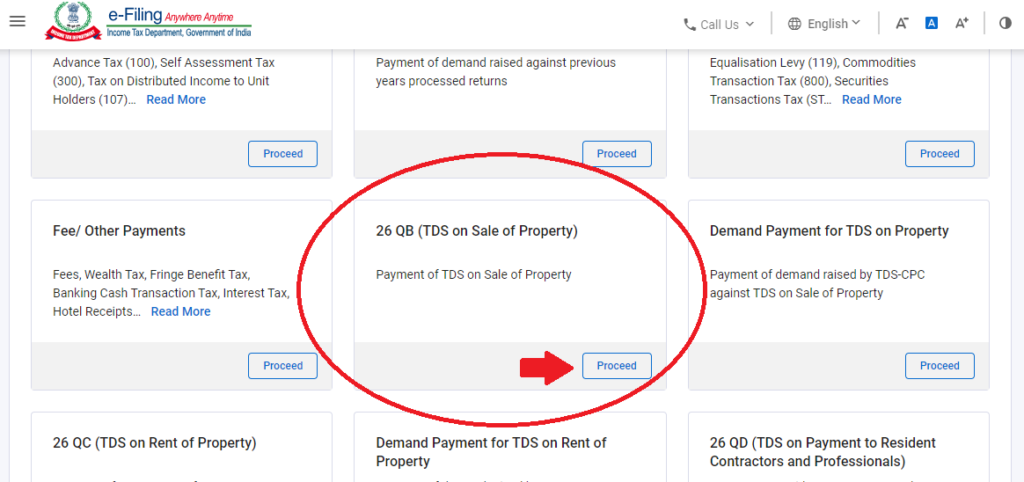

How to deposit the TDS deducted – Filing Form 26QB (TDS Return)

The TDS that the buyer deducts, needs to be deposited in govt account through Form 26QB (TDS Return), using PAN of Seller, so the TDS credit gets reflected in the Sellers Tax Credit Statement (26AS) and AIS.

To know the process in detail, click here.

FAQ’s Frequently Asked Questions

Who is required to file Form 26QB (TDS Return)?

The Buyer, who is responsible to make payment of Sale Consideration in respect of purchasing an immovable property, shall deduct tax as per Section 194-IA provisions, and deposit the tax amount online through Form 26QB (TDS Return). Tax is to be deducted only if the Seller is a Resident of India.

When is TDS under Section 194-IA to be deducted?

If an immovable property, other than rural agricultural land, is transferred (sold), tax shall be deducted if the amount of sale consideration or the stamp duty value of the immovable property [Whichever is higher] is Rs. 50 lakhs or more (Aggregate)

What is the rate of TDS (Tax Deducted At Source)?

Tax shall be deducted at the rate of 1% of sales consideration or stamp duty value, whichever is higher. There is no Surcharge and Health & Education Cess.

How and When to deposit the TDS?

To deposit the tax, the deductor (Buyer) has to file a challan cum statement in Form 26QB (TDS Return) within 30 days from the last day of the month in which the tax has been deducted.

What are the consequences of failure to deposit TDS?

If any person, who is responsible for the deduction of tax at source, fails to deduct or after deduction fails to deposit the same to the credit of the Central Government, he shall be deemed to be an assessee-in-default. In such case, he shall be liable for payment of interest under section 201.

Further, any person who is deemed as an assessee-is-default shall be liable for payment of penalty under section 271C which shall not exceed the amount he failed to deduct. Further, he shall be liable for prosecution under section 272B .